New data from the Employee Benefit Research Institute shows that for retirees 75 and older, debt has actually increased. In fact, nearly a fifth of all bankruptcies in the United States come from those older than 55. With the economy in a prolonged weakened state, many baby boomers are short on retirement savings and still … Read more

Loan modifications continue to be an amazing option for distressed homeowners trying to avoid foreclosure. A loan modification might be the most important thing you do while saving your home, so it’s important to do it right! However, despite the number of qualified homeowners filing applications, countless mortgage loan modifications are denied because of the … Read more

Energy Future Holdings (EFH) electrified headlines this week as rumors grew that the company might file for a Dallas bankruptcy. In its annual report filed with the Securities and Exchange Commission, EFH warned about their financial restrictions and limited flexibility, and that any unexpected breach could result in a default of their debt agreements. Energy … Read more

In today’s economy, it’s no longer enough just to watch after your own finances. For many people, one of the most alarming moments isn’t managing their own budget, but discovering that their employer has filed for Business Chapter 7 bankruptcy. Unlike Chapter 11, Business Chapter 7 means that your employer is shutting down and terminating … Read more

Each year, there are more bankruptcy myths that emerge that deter people from managing their debt. Even though speaking with a bankruptcy attorney would clear up many misconceptions, people are intimidated by bankruptcy myths, thereby limiting a potential debt management option. However, clearing these misconceptions might help you realize that bankruptcy is a positive possibility … Read more

For many people, bankruptcy is the only option to defend against mortgage debts and the risk of foreclosure. While there are two options for managing your mortgage debts in bankruptcy, they each carry different benefits and risks. Chapter 7 When you file for Chapter 7 much of your unsecured debt can be written off, allowing … Read more

The high profile bankruptcy case of acquitted mother, Casey Anthony, has been hitting headlines for weeks. After much deliberation about the possibility of a “media circus”, the court has ruled that her bankruptcy hearing will stay in Tampa. Wrong Victim Casey Anthony has been in the forefront of accusation and identified as the face of … Read more

Thankfully, there are many options for unmanageable debt. While some people seek professional guidance from a debt counselor or a credit repair company, there are others who prefer to handle the situation themselves. By handling debt negotiation, you have the opportunity to bargain for your preferred terms on repaying your debt. Though debt negotiation doesn’t … Read more

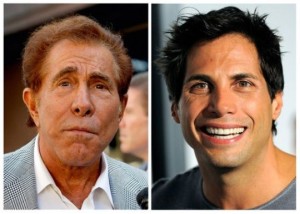

This week in bankruptcy news: the ‘Girls Gone Wild’ management company files for bankruptcy to avoid paying a debt owed to the Wynn Casino in Las Vegas, for a judgement of slander and making defamatory statements. The bakery giant Bimbo is challenging a rival bid in the Hostess bankruptcy auction, claiming the attempt is nothing … Read more

Recent studies show that Dallas has one of the lowest foreclosure rates in the nation, statistically only experiencing a third of the foreclosures that cities like Atlanta or Phoenix witness. Still, many families struggle with their mortgage, and foreclosure looms over them like their own fiscal cliff. Fortunately, refinancing options provide homeowners the opportunity to … Read more